27 July 2022 – Jakarta

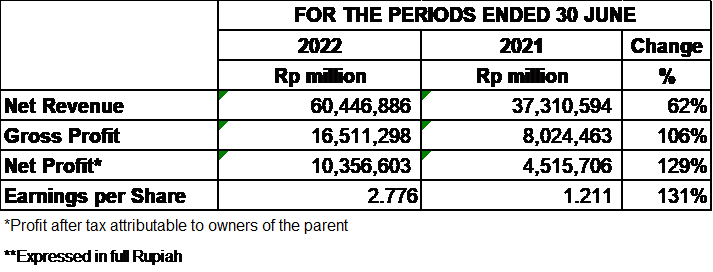

Today PT United Tractors Tbk (“the Company”) released its consolidated financial statements for the first half 2022. As of 30 June 2022, the Company recorded net revenue of Rp60.4 trillion, increased by 62% compared to Rp37.3 trillion in the same period of 2021. In line with the increase in net revenue, the Company’s net profit was up by 129% to Rp10.4 trillion, from Rp4.5 trillion.

Overall, to the Company’s consolidated net revenue, the Construction Machinery segment contributed 29%, followed by 33% from Mining Contracting, 31% from Coal Mining, 6% from Gold Mining and 1% from Construction Industry.

Construction Machinery Segment

The Construction Machinery segment recorded an increase in Komatsu sales volume by 111% to 2,873 units from 1,361 units. Based on internal market research, Komatsu leads the market with 28% market share. Revenue of spare parts and maintenance services also increased by 36% to Rp4.8 trillion.

Due to issues of limited supply, the sales volume of UD Trucks decreased from 289 units to 258 units, and Scania products decreased from 346 units to 111 units. In total, the Construction Machinery segment recorded net revenue of Rp17.4 trillion or increased by 86% compared to last year.

Mining Contracting Segment

The Company operates its Mining Contracting segment through PT Pamapersada Nusantara (PAMA). As of June 2022, PAMA recorded net revenue of Rp20.0 trillion, up by 29% from Rp15.4 trillion. PAMA recorded 13% decrease in coal production from 58 million tons to 50 million tons and 7% higher of overburden removal volume from 410 million bcm to 437 million bcm, with an average strip ratio of 8.7x increased from 7.1x.

Coal Mining Segment

The Company’s coal mining business segment is operated by PT Tuah Turangga Agung (TTA). TTA operates two thermal coal mines: PT Asmin Bara Bronang (ABB) and PT Telen Orbit Prima (TOP), as well as one metallurgical coal mine: PT Suprabari Mapanindo Mineral (SMM).

As of June 2022, TTA recorded total coal sales volume of 5.8 million tons, including 1.3 million tons of metallurgical coal from SMM, or decreased by 8% compared to 6.3 million tons year on year, due to temporary coal export restrictions that occurred in January 2022. Despite the lower sales volume, the Coal Mining segment recorded a 149% increase in net revenue to Rp18.7 trillion due to higher average coal selling price.

Gold Mining Segment

The Company’s gold mine business is operated by PT Agincourt Resources (PTAR). PTAR operates Martabe gold mine located in North Sumatra. Until June 2022, total sales volume of gold equivalent from Martabe was 144 thousand ounces, lower by 18% compared to 176 thousand ounces last year, due to lower grade extraction. Gold mining segment recorded net revenue of Rp3.9 trillion, decreased by 10% from Rp4.3 trillion. The average selling price for gold was USD1,873 per ounce, increased by 8% compared to USD1,730 per ounce in the same period of 2021.

Construction Industry Segment

The Construction Industry segment is represented by PT Acset Indonusa Tbk (ACSET). As of June 2022, Construction Industry reported net revenue of Rp476 billion, compared to Rp636 billion in 2021. ACSET recorded a net loss of Rp114 billion, decreased compared to net loss in the same period last year of Rp153 billion. The net loss was mainly due to the slowdown of several ongoing projects and reduced new construction project opportunities during the pandemic.

Energy Segment

In line with the Company’s business development strategy in environmentally friendly energy sector, the Company has determined renewable energy business as one of its transition strategies. To accelerate the development of renewable energy, by the end of 2021 all energy businesses in the group have been consolidated through PT Energia Prima Nusantara (EPN). Until June 2022, EPN has installed 6.9 MWp Rooftop Solar PV in the Company’s and Astra’s group facilities. This year, the Company targets an addition of 15 MWp new Rooftop Solar PV installations and more in the following years.

The Company currently operates one mini hydro power plant namely PLTMH Kalipelus 0.5 MW in Central Java and in the process of constructing another mini hydro power plant, PLTMH Besai Kemu in Lampung, Sumatra. The capacity of PLTMH Besai Kemu is 7 MW and is expected to operate in 2023. In addition, the Company also targets several mini hydro projects in Sumatra area with total potential of more than 20 MW.

At the same time, the Company actively conducts studies and reviews of other types of renewable energy, such as large-scale hydropower, floating solar PV, geothermal, wind power, and waste-to-energy projects. These projects are consistent with UT’s strategy to increase its competence in various renewable energy potentials to achieve a sustainable business portfolio.

On 12 July 2022, the Company submitted a disclosure of information regarding Share Buyback with the maximum amount of Rp5 trillion. The Company Share Buyback shall be carried out in stages for a period of 3 months from 13 July to 12 October 2022.

For further information, please contact the following:

|

Corporate Secretary |

: Sara Loebis |

|

|

|

|

Address |

: Jl. Raya Bekasi Km.22 Cakung, Jakarta Timur 13910 |

|

Phone |

: (62-21) 24579999, Fax: (62-21) 4600655 |