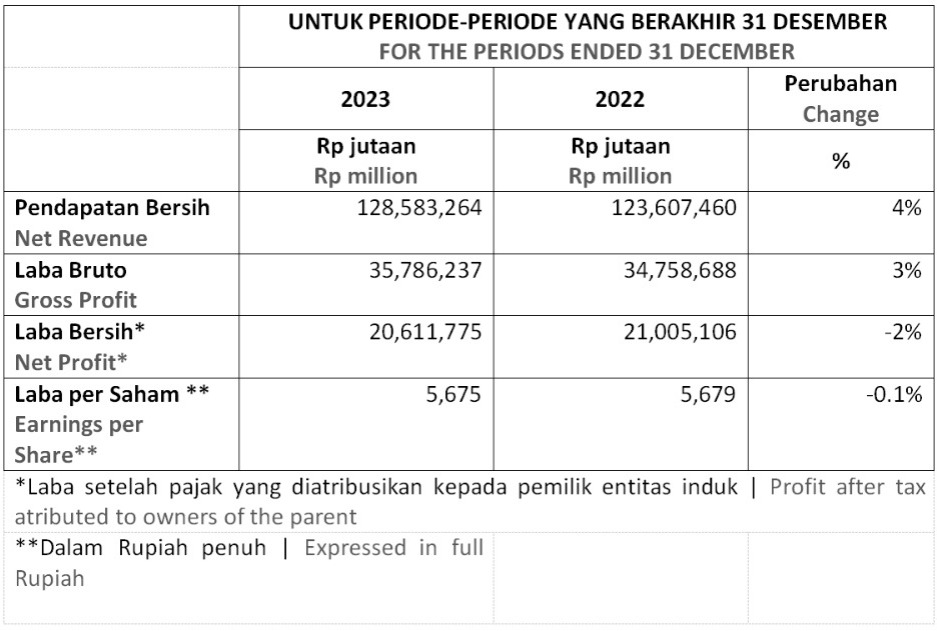

Jakarta, 27th February 2024 – Today PT United Tractors Tbk (“the Company”) released its consolidated financial statements for the full year of 2023. The Company recorded net revenue of Rp128.6 trillion, increased by 4% compared to Rp123.6 trillion in 2022. The Company’s gross profit increased by 3% from Rp34.8 trillion to Rp35.8 trillion. Meanwhile, the Company’s net profit slightly decreased by 2% to Rp20.6 trillion from Rp21.0 trillion due to higher finance costs and foreign exchange losses.

Construction Machinery Segment

The Construction Machinery segment recorded a decrease in Komatsu sales volume by 8% to 5,270 units from 5,753 units. Based on internal market research, Komatsu leads the heavy equipment market with a 29% market share. Revenue from spare parts and maintenance services increased by 12% to Rp11.6 trillion.

Sales volume of Scania increased from 233 units to 715 units, while UD Trucks sales decreased from 429 units to 272 units due to limited supply availability from principal. In total, the Construction Machinery segment recorded a slightly higher net revenue of Rp36.6 trillion compared to 2022.

Mining Contracting Segment

The Company operates its Mining Contracting segment through PT Pamapersada Nusantara (PAMA). As of December 2023, PAMA recorded net revenue of Rp54.0 trillion, up by 14% from Rp47.4 trillion. PAMA recorded an 11% increase in coal production from 116 million tons to 129 million tons and a 21% increase in overburden removal volume from 954 million bcm to 1.2 billion bcm, with the average stripping ratio of 9.0x, increased from 8.2x.

Coal Mining Segment

The Company’s coal mining business segment is operated by PT Tuah Turangga Agung (TTA). As of December 2023, TTA recorded total coal sales volume of 11.8 million tons, including 2.5 million tons of metallurgical coal from SMM, 19% increase compared to last year. Coal Mining segment recorded 2% decrease in net revenue to Rp30.5 trillion from Rp31.1 trillion due to the decline in the average selling price of coal.

Gold and Other Mineral Mining Segment

The Company’s gold mine business is operated by PT Agincourt Resources (PTAR). PTAR operates Martabe gold mine located in North Sumatra. Until December 2023, total sales volume of gold equivalent from Martabe was 175 thousand ounces, lower by 39% compared to 286 thousand ounces last year. The Gold and Other Mineral Mining segment recorded net revenue of Rp5.2 trillion, decreased by 32% from Rp7.7 trillion.

Construction Industry Segment

The Construction Industry segment is represented by PT Acset Indonusa Tbk (ACSET). As of December 2023, Construction Industry reported net revenue of Rp2.2 trillion, higher by 136% compared to Rp949 billion in the same period of 2022. ACSET recorded a 40% lower net loss of Rp270 billion, compared to Rp449 billion in 2022.

Energy Segment

In line with the Company’s business development strategy in green energy sector, the Company has determined renewable energy business as one of its transition strategies. The Company’s energy business is conducted through its wholly owned subsidiary, PT Energia Prima Nusantara (EPN). As of December 2023, EPN has installed 15.1 MWp of Rooftop Solar PV in a number of Astra group facilities.

EPN is currently operating two mini hydro power plants, PLTM Kalipelus with the capacity of 0.5 MW and PLTM Besai Kemu in Lampung, Sumatra with the capacity of 7 MW which began commercial operations in January 2024. In addition, EPN is also targeting several mini hydro power plant projects in Sumatra area with a total potential capacity of more than 20 MW.

In August 2022, the Company invested in PT Arkora Hydro Tbk (Arkora) with a 31.49% shareholding. Currently, Arkora operates two mini hydro power plants, PLTM Cikopo 2 in West Java with a capacity of 7.4 MW, and PLTM Tomasa in Central Sulawesi with a capacity of 10 MW. Arkora is currently developing another two mini hydro power plants, PLTM Koro Yaentu with the capacity of 10 MW and PLTM Kukusan 2 with the capacity of 5.4 MW, both are expected to start operation in 2024 and 2025. When the operation of these two projects starts, Arkora will own power plants with a total capacity of 33 MW. Besides that, in December 2023, Arkora signed a Power Purchase Agreement with PLN for the construction of the 10 MW Tomini MW project located in South Sulawesi.

The Company actively conducts studies related to other renewable energy projects such as geothermal, solar, and waste-to-energy. These projects are consistent with UT’s strategy to increase its competence in various renewable energy potentials to achieve a sustainable business portfolio.

Event Highlights

On 30th November 2023, the Company through its wholly owned subsidiary PT Danusa Tambang Nusantara (DTN) completed a transaction to acquire 70% share ownership of PT Stargate Pasific Resources (SPR), a nickel mining company and PT Stargate Mineral Asia (SMA), a nickel processing company, both located in North Konawe, Southeast Sulawesi, for a total investment of Rp3.2 trillion. Subsequently on 1st December 2023, the Company through DTN completed the transaction to acquire 66.67% share ownership of PT Anugerah Surya Pacific Resources (ASPR), the holding company which has 30% ownership of SPR and SMA for a total value of Rp1.6 trillion.

On 27th December 2023, the Company through its wholly owned subsidiary PT Energia Prima Nusantara (EPN) completed a new share subscription to acquire 49.6% of PT Supreme Energy Sriwijaya (SES) for a total value of USD51.9 million. SES is a 25.2% shareholder of PT Supreme Energy Rantau Dedap (SERD) which owns an operating geothermal project in South Sumatera with an existing capacity of 2 x 49 MW.

For further information, please contact the following:

|

Corporate Secretary |

: Sara Loebis |

|

|

|

|

Address |

: Jl. Raya Bekasi Km.22 Cakung, Jakarta Timur 13910 |

|

Phone |

: (62-21) 24579999, Fax: (62-21) 4600655 |